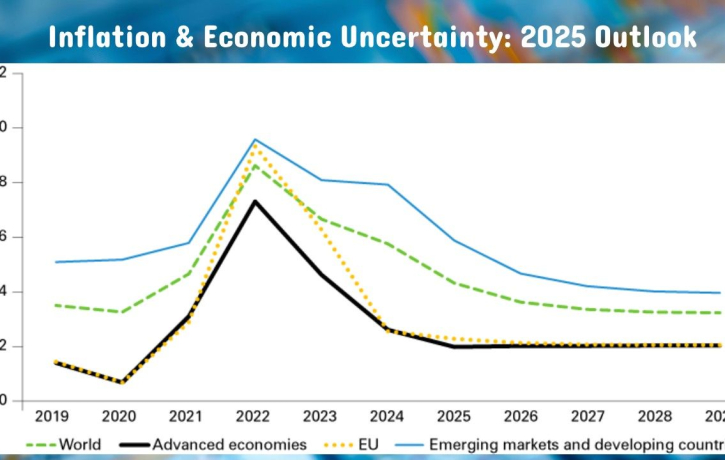

Inflation & Economic Uncertainty: 2025 Outlook. As we move through 2025, global economies continue to wrestle with the lasting effects of pandemic-era disruptions, geopolitical tensions, and rapid consumer and market behavior shifts. Inflation and economic uncertainty remain at the forefront of public discourse and policymaking, challenging businesses and households. Here’s a closer look at the landscape, the driving forces behind it, and what the year may hold.

Persistent Inflation: What’s Driving It?

Although Inflation & Economic Uncertainty: 2025 Outlook has moderated from the peak levels seen in 2022 and 2023, it remains elevated in many parts of the world. Key drivers include:

-

Supply Chain Adjustments: While global supply chains have improved, lingering bottlenecks and shifts toward regional manufacturing continue to impact costs.

-

Labor Market Tightness: Wage growth remains robust in several sectors, particularly healthcare, logistics, and technology, contributing to upward pressure on prices.

-

Energy Volatility: Ongoing geopolitical tensions—particularly in Eastern Europe and the Middle East—are fueling instability in energy markets, driving up costs across industries.

-

Climate Impact: Weather-related disruptions are increasingly affecting agriculture and resource availability, further straining supply and driving food price inflation.

Interest Rates and Central Bank Responses

In response to stubborn inflation, central banks—including the U.S. Federal Reserve, the European Central Bank, and the Bank of England—have maintained cautious monetary policies. While some easing has occurred, rates remain relatively high by post-2008 standards. The goal is to anchor inflation expectations without stifling economic growth, a delicate balancing act that continues to pose risks.

Consumer and Business Sentiment

Uncertainty has become the new normal. Consumers are more cautious, prioritizing essential spending and value-driven purchasing. Businesses, especially small and medium-sized enterprises (SMEs), are adjusting strategies by:

-

Cutting non-essential expenditures

-

Reassessing supply chain resilience

-

Exploring automation and AI to reduce costs

-

Delaying major investments until economic conditions stabilize

Despite these headwinds, sectors such as green energy, AI, and healthcare are showing resilience and even growth, drawing strong investor interest.

Global Disparities and Regional Variations

While advanced economies are navigating inflation with policy tools and financial cushions, many developing nations face greater challenges. High debt burdens, weaker currencies, and limited fiscal capacity make them more vulnerable to external shocks. Regional disparities in inflation, employment, and investment flows are expected to widen unless coordinated global efforts are made.

What to Watch in the Second Half of 2025

-

Central Bank Shifts: Any indications of rate cuts or further tightening will significantly influence markets and consumer confidence.

-

Geopolitical Developments: Elections, wars, and trade tensions will continue to affect economic stability.

-

Technological Innovation: Advances in automation, AI, and sustainability efforts may offer relief or disruption, depending on the sector.

-

Consumer Behavior: Shifting preferences and spending habits will shape market trends, particularly in retail, housing, and digital services.

Conclusion

Inflation & Economic Uncertainty: 2025 Outlook requires vigilance, flexibility, and forward-thinking strategies. For policymakers, businesses, and individuals alike, success will depend on the ability to adapt quickly to shifting economic winds while planning for long-term resilience. Though challenges remain, so too do opportunities for innovation, investment, and growth in a transforming global economy.